Child tax credit portal login non filers information

Home » News » Child tax credit portal login non filers informationYour Child tax credit portal login non filers images are available in this site. Child tax credit portal login non filers are a topic that is being searched for and liked by netizens now. You can Download the Child tax credit portal login non filers files here. Download all royalty-free images.

If you’re looking for child tax credit portal login non filers images information related to the child tax credit portal login non filers topic, you have visit the right site. Our website frequently provides you with suggestions for downloading the highest quality video and image content, please kindly surf and find more informative video content and graphics that match your interests.

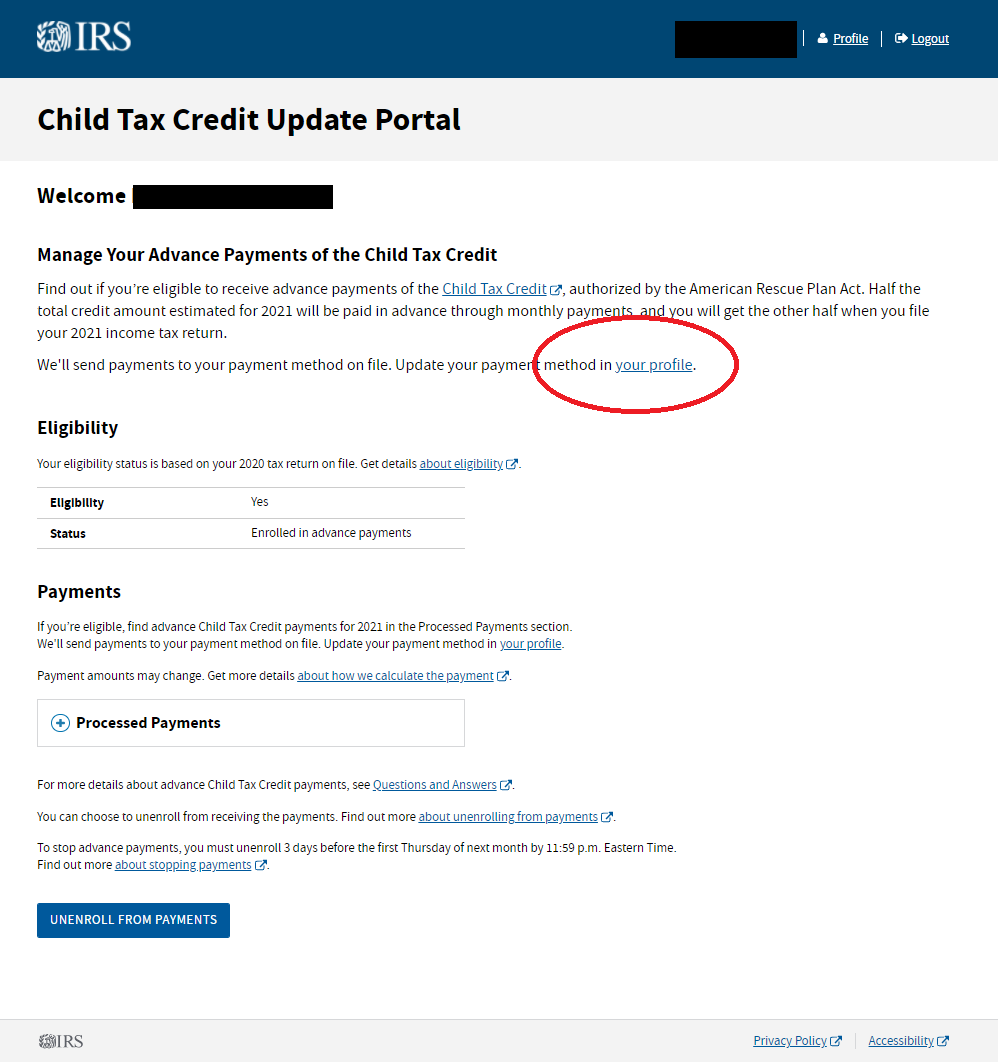

Child Tax Credit Portal Login Non Filers. The agency opened the portal on its website as the White House announced Child Tax Credit Awareness Day on Monday to raise awareness about the extra stimulus funds for families. Allows you to provide information about your qualifying children for 2020. Citizens and their parents income meets the eligibility requirements. The IRS will pay half the total credit amount in advance monthly payments.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back From taxoutreach.org

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back From taxoutreach.org

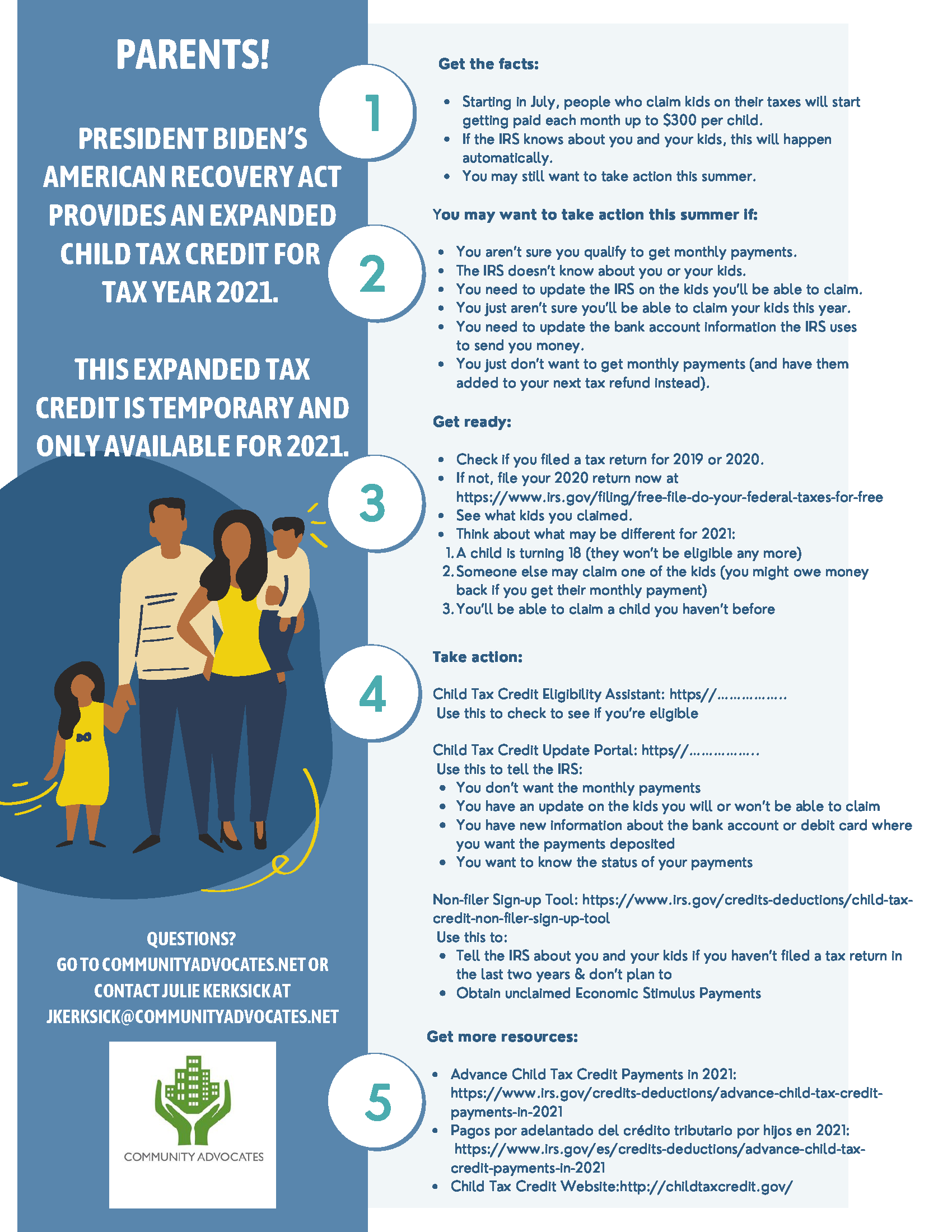

Non-filer Tool Helps Families Who Arent Normally Required to File Tax Returns Register for Child Tax Credit Treasury Also Releases Information to Help Organizations Focus Outreach Efforts to Sign Families Up for Monthly Payments of the Child Tax Credit WASHINGTON The US. All children under the age of 18 qualify for the child tax credit as long as they are US. The maximum child tax credit was increased this year as part of the 19 trillion American Rescue Plan the same legislation that authorized stimulus payments in March 2021. Citizens and their parents income meets the eligibility requirements. THE IRS has opened an online portal allowing non-filers to register information to receive the 3600 child tax credit when first payments are issued on July 15. But now the IRS will make it possible for non-filers to benefit from the expanded Child Tax Credit.

The child tax credit payments are advances on next years tax refund for eligible parents.

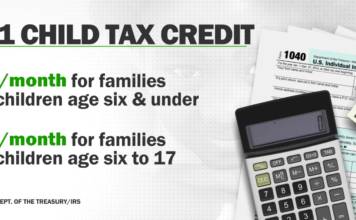

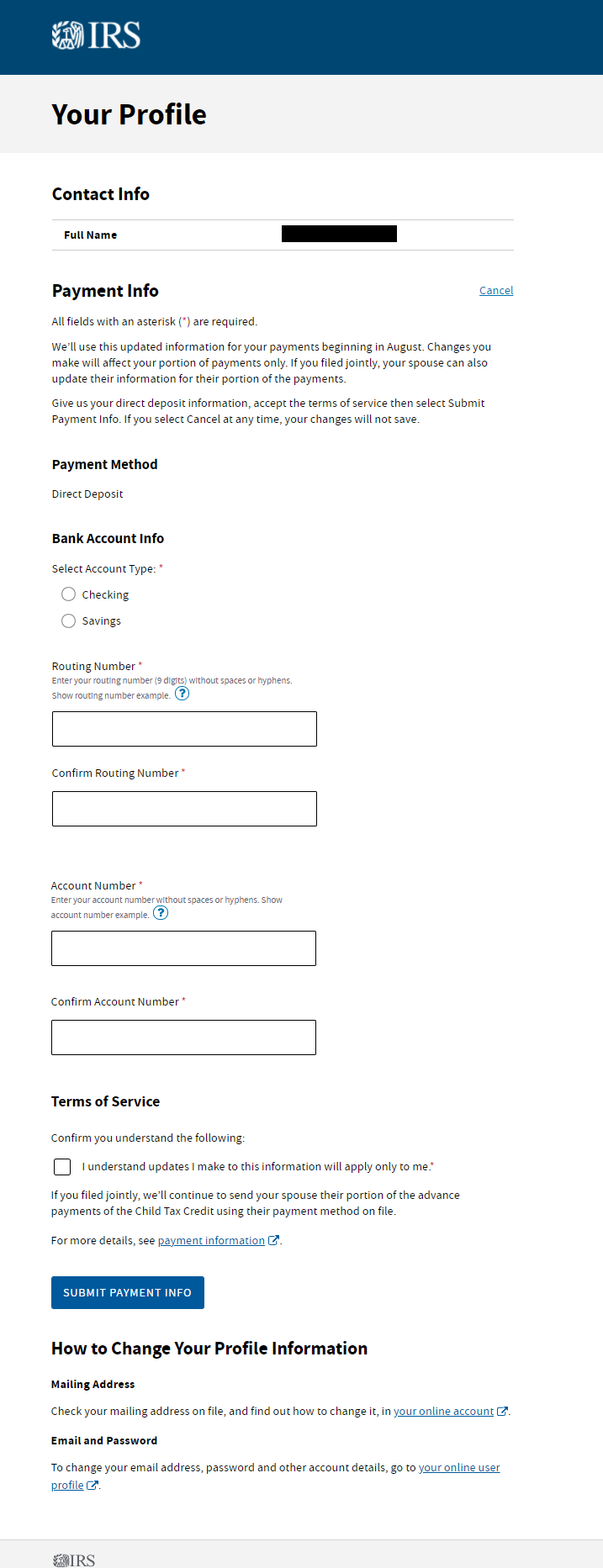

Non-filer Sign-up Tool for Child Tax Credit and Economic Impact Payments. Department of the Treasury and the Internal Revenue Service announced today the availability of a new online tool. Thanks to the new IRS portal non-filers can register for the Child Tax Credit online. Child Tax Credit Non-filer Sign-up Tool. This year eligible families can earn up to 3600 per child ages 5 and younger and up to 3000 per child ages 6 to 17 an increase from the maximum 2000 per child. Or December 31 at 1159 pm if your child was born in the US.

Source: forbes.com

Source: forbes.com

Not this year though. But now the IRS will make it possible for non-filers to benefit from the expanded Child Tax Credit. June 28 2021. The maximum child tax credit was increased this year as part of the 19 trillion American Rescue Plan the same legislation that authorized stimulus payments in March 2021. Non-filer Tool Helps Families Who Arent Normally Required to File Tax Returns Register for Child Tax Credit Treasury Also Releases Information to Help Organizations Focus Outreach Efforts to Sign Families Up for Monthly Payments of the Child Tax Credit WASHINGTON The US.

This tool can be used by low. THE IRS has opened an online portal allowing non-filers to register information to receive the 3600 child tax credit when first payments are issued on July 15. This year eligible families can earn up to 3600 per child ages 5 and younger and up to 3000 per child ages 6 to 17 an increase from the maximum 2000 per child. The Child Tax Credit Update Portal allows you to verify your eligibility for the payments. Child Tax Credit CTC Sign-up Guide for Non-filers 9 Show the dependents who you think you can get CTC payments for.

Source: taxoutreach.org

Source: taxoutreach.org

The maximum child tax credit was increased this year as part of the 19 trillion American Rescue Plan the same legislation that authorized stimulus payments in March 2021. The maximum child tax credit was increased this year as part of the 19 trillion American Rescue Plan the same legislation that authorized stimulus payments in March 2021. A child is your qualifying child for the 2020 Child Tax Credit if the child meets all the following conditions for 2020. Theres good news for families that dont traditionally file taxes but have children who are. Non-filer Tool Helps Families Who Arent Normally Required to File Tax Returns Register for Child Tax Credit Treasury Also Releases Information to Help Organizations Focus Outreach Efforts to Sign Families Up for Monthly Payments of the Child Tax Credit WASHINGTON The US.

Source: proconnect.intuit.com

Source: proconnect.intuit.com

Non-filer Tool Helps Families Who Arent Normally Required to File Tax Returns Register for Child Tax Credit Treasury Also Releases Information to Help Organizations Focus Outreach Efforts to Sign Families Up for Monthly Payments of the Child Tax Credit WASHINGTON The US. Allows you to provide information about your qualifying children for 2020. Citizens and their parents income meets the eligibility requirements. Non-tax filer families will soon be able to sign up for the enhanced monthly child tax credit. Theres good news for families that dont traditionally file taxes but have children who are.

Source: pinterest.com

Source: pinterest.com

Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. But now the IRS will make it possible for non-filers to benefit from the expanded Child Tax Credit. Non-filer Sign-up Tool for Child Tax Credit and Economic Impact Payments. The agency opened the portal on its website as the White House announced Child Tax Credit Awareness Day on Monday to raise awareness about the extra stimulus funds for families. Just use the boxes under Qualifies for CTC.

Source: communityadvocates.net

Source: communityadvocates.net

Its the first in a series of advanced payments of the c. This year eligible families can earn up to 3600 per child ages 5 and younger and up to 3000 per child ages 6 to 17 an increase from the maximum 2000 per child. Not this year though. Just use the boxes under Qualifies for CTC. Allows you to provide information about your qualifying children for 2020.

Source: in.pinterest.com

Source: in.pinterest.com

Non-tax filer families will soon be able to sign up for the enhanced monthly child tax credit. Thanks to the new IRS portal non-filers can register for the Child Tax Credit online. Non-tax filer families will soon be able to sign up for the enhanced monthly child tax credit. You will claim the other half when you file your 2021 income tax return. Not this year though.

Source: in.pinterest.com

Source: in.pinterest.com

It doesnt matter if they were born on January 1 at 1201 am. THE IRS has opened an online portal allowing non-filers to register information to receive the 3600 child tax credit when first payments are issued on July 15. If youre a parent you probably noticed some extra cash in your bank account from the IRS last week. But now the IRS will make it possible for non-filers to benefit from the expanded Child Tax Credit. In June it plans to launch a portal that will allow non-filers to input their information in.

Source: savingtoinvest.com

Source: savingtoinvest.com

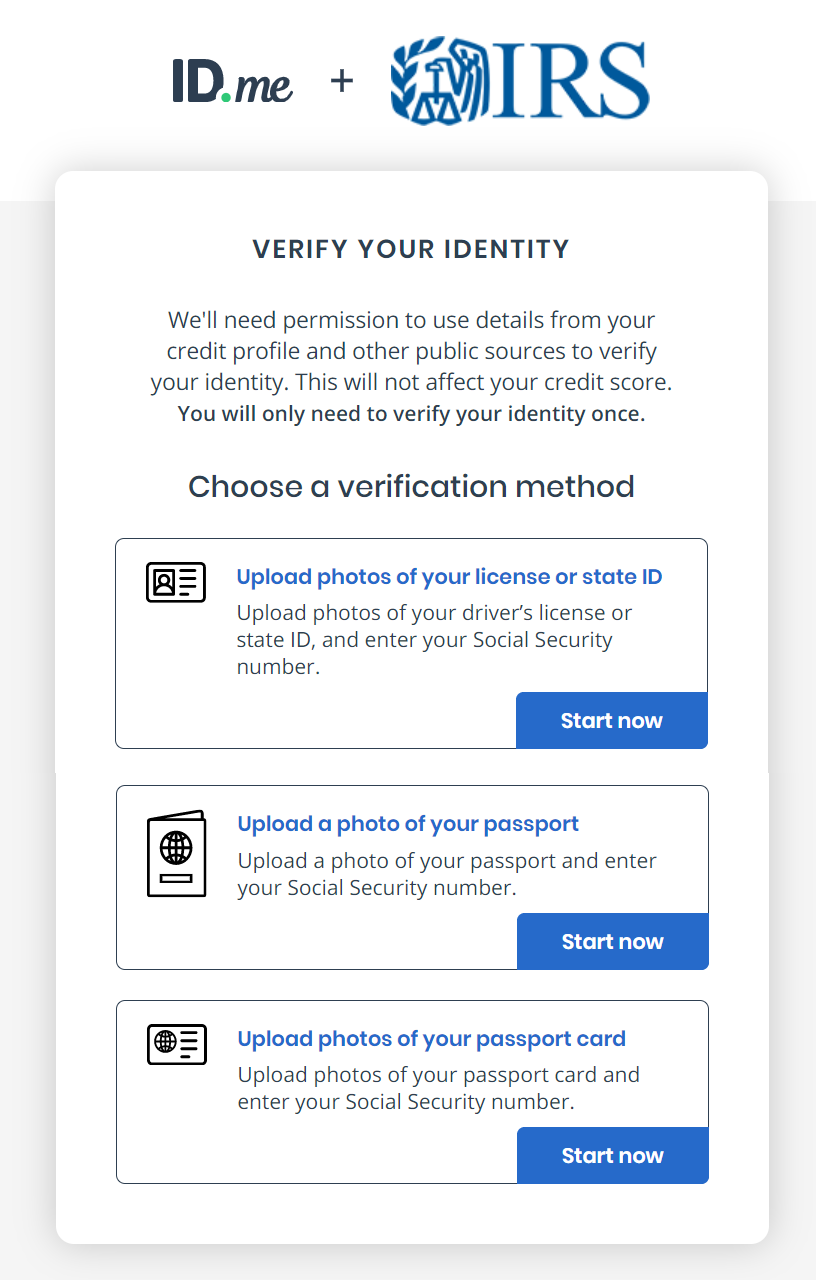

How to access the Child Tax Credit non-filers online portal The portal is designed for those who have not filed either a 2019 or 2020 tax return. Non-filer Sign-up Tool for Child Tax Credit and Economic Impact Payments. Theres good news for families that dont traditionally file taxes but have children who are. The IRS will pay half the total credit amount in advance monthly payments. You can also use the tool to unenroll from receiving the monthly payments if you prefer to receive a lump sum when you file your tax return next year.

Source: winknews.com

Source: winknews.com

To sign up with the IRS non-tax-filers will need to submit their. Child Tax Credit CTC Sign-up Guide for Non-filers 9 Show the dependents who you think you can get CTC payments for. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. Citizens and their parents income meets the eligibility requirements. In 2021 then you will receive the child tax credit.

How to access the Child Tax Credit non-filers online portal The portal is designed for those who have not filed either a 2019 or 2020 tax return. This tool can be used by low. The agency opened the portal on its website as the White House announced Child Tax Credit Awareness Day on Monday to raise awareness about the extra stimulus funds for families. Yes you will get the entire credit for your baby. The Child Tax Credit Update Portal allows you to verify your eligibility for the payments.

Source: news10.com

Source: news10.com

Its the first in a series of advanced payments of the c. In June it plans to launch a portal that will allow non-filers to input their information in. Department of the Treasury and the Internal Revenue Service announced today the availability of a new online tool. It doesnt matter if they were born on January 1 at 1201 am. Theres good news for families that dont traditionally file taxes but have children who are.

Source: taxoutreach.org

Source: taxoutreach.org

Citizens and their parents income meets the eligibility requirements. Thanks to the new IRS portal non-filers can register for the Child Tax Credit online. A child is your qualifying child for the 2020 Child Tax Credit if the child meets all the following conditions for 2020. It doesnt matter if they were born on January 1 at 1201 am. This year eligible families can earn up to 3600 per child ages 5 and younger and up to 3000 per child ages 6 to 17 an increase from the maximum 2000 per child.

Source: newamerica.org

Source: newamerica.org

If you had total income in 2020 below those levels you can sign up to receive monthly Child Tax Credit payments using a simple tool for non-filers available on the IRSs website. Just use the boxes under Qualifies for CTC. Youll get half of the money over the course of seven payments in 2021 and 2022. This year eligible families can earn up to 3600 per child ages 5 and younger and up to 3000 per child ages 6 to 17 an increase from the maximum 2000 per child. Or December 31 at 1159 pm if your child was born in the US.

Source: taxoutreach.org

Source: taxoutreach.org

You will claim the other half when you file your 2021 income tax return. June 28 2021. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. Not this year though. The new portal is only for people who have not filed a 2019 or 2020 tax return and who did not use the IRS non-filers tool in 2020 to register for economic impact payments.

Source: usow.org

Source: usow.org

How to access the Child Tax Credit non-filers online portal The portal is designed for those who have not filed either a 2019 or 2020 tax return. This year eligible families can earn up to 3600 per child ages 5 and younger and up to 3000 per child ages 6 to 17 an increase from the maximum 2000 per child. Thanks to the new IRS portal non-filers can register for the Child Tax Credit online. Child Tax Credit CTC Sign-up Guide for Non-filers 9 Show the dependents who you think you can get CTC payments for. Citizens and their parents income meets the eligibility requirements.

Just use the boxes under Qualifies for CTC. This tool can be used by low. Citizens and their parents income meets the eligibility requirements. All children under the age of 18 qualify for the child tax credit as long as they are US. Just use the boxes under Qualifies for CTC.

Source: youtube.com

Source: youtube.com

It doesnt matter if they were born on January 1 at 1201 am. THE IRS has opened an online portal allowing non-filers to register information to receive the 3600 child tax credit when first payments are issued on July 15. This tool can be used by low. The agency opened the portal on its website as the White House announced Child Tax Credit Awareness Day on Monday to raise awareness about the extra stimulus funds for families. The new portal is only for people who have not filed a 2019 or 2020 tax return and who did not use the IRS non-filers tool in 2020 to register for economic impact payments.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title child tax credit portal login non filers by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- La liga zamora trophy information

- Bella poarch first viral tiktok information

- Brentford fc where to watch information

- Zero child tax credit information

- Irs child tax credit questions and answers information

- Child tax credit portal how much will i get information

- Tony bennett in concert information

- Disney stock january 2021 information

- Buffalo bills detroit lions information

- Premier league games this weekend information